tax fraud lawyer uk

United Kingdom whistleblower law permits all UK citizens to report frauds against the US. The FCA the UKs financial services regulator also has as one of its statutory objectives the reduction of financial crime which includes fraud.

Tax Evasion What You Need To Know The Tax Lawyer

Failing to prevent the facilitation of tax evasion is a serious offence in UK and persons accused of such crimes should seek immediate legal advice from our tax fraud lawyer.

. The firm has won the Legal 500 award for Criminal Fraud Law Firm of the Year. If accepted as a client you can expect the entire Barnes Law team to be available to do whatever it takes to protect you and your family. In 2015 Parliaments Public Accounts Committee described the number of prosecutions for offshore tax evasion as woefully inadequate1 In 2016 the Committee called on.

A tax fraud attorney represents clients who the government claims have manipulated the system by paying too little tax or no tax at all. Prosecutions for tax fraud and other tax crimes HMRC has faced calls to do more to tackle tax fraud through criminal prosecution for some time. Financial Conduct Authority FCA Investigation and Enforcement Powers.

However the good news is that the tax fraud lawyers at Purcell Parker can guide you through every aspect of being investigated for tax fraud or tax. Government under the False Claims Act or violations of the provisions of the Securities Exchange Act Foreign Corrupt Practice Act or Commodities Exchange Act. As UK tax law becomes increasingly complex businesses and individuals need specialist tax lawyers able to identify the risks and opportunities and to help them ensure compliance.

No two cases are ever the same in what can be a complicated area of the law to navigate. No answer to a question is legal advice and no lawyer-client relationship is created between the person asking the question and the person answering it. Informed by research approaches from across tax law public economics criminology criminal justice economics of crime and regulatory theory it assesses the effectiveness and the legitimacy of current approaches to combating tax fraud bringing new.

We never allow our clients to be interviewed. Hamraj Kang the founding solicitor of the firm has won the Legal 500 award for Individual Criminal Fraud Solicitor of the Year as well as being ranked as a star. The firm is well known as a blue-chip firm for white-collar crime that represent individuals investigated for tax fraud also Legal 500 UK 2021.

Magnitsky a lawyer hired by Browders London-based Hermitage Capital Management fund uncovered a 230m 150m tax fraud scheme run by a host of Russian interior ministry and tax officials. This article presents a new conceptual framework for research into tax fraud and law enforcement. Berman the United States Attorney for the Southern District of New York announced that a federal jury today found MICHAEL LITTLE guilty of charges that he participated in an 11-year tax fraud scheme in which.

Chinnery Associates are specialist HMRC fraud lawyers and can advise you about any sentence which may be imposed arising out of tax evasion. Their experience and expertise in even the most complex and sophisticated Fraud cases means youll have the best possible chance of a successful outcome to the challenge you are facing. Equality before the law.

HMRC the UKs tax authority said it was the first seizure of NFTs. Where appropriate you should consult your own lawyer for legal advice. Both leading directories the Legal 500 and Chambers UK rank the firm in the highest categories for white collar fraud defence work.

Anyone with information about tax fraud should report it online or call our Fraud Hotline on 0800 788 887. Our tax lawyers have comprehensive knowledge of UK tax law and deep sector insight providing the highest level of legal advice to our clients. You may be fined or even jailed for tax fraud.

When you call Barnes Laws office about an issue related to tax fraud or evasion tax fraud attorney Robert Barnes will personally review your situation often during a 30-minute phone call. Chambers Research is conducted by 200 Research Analysts across 200 jurisdictions and provides nearly 6000 rankings tables. The FCA is empowered to enforce against firms and individuals for breaches of the relevant rules.

By BCL Solicitors LLP. Our criminal investigations aim to achieve prosecutions with a. Bright and dedicated lawyers Chambers UK 2021.

Harry Travers Greg Mailer and Umar Azmeh review HMRCs approach and argue that its failure to produce meaningful statistics should not mask the fact that it is criminally prosecuting low-hanging fruit. Regarded as one of the best financial crime firms. Tax fraud and tax evasion are considered serious crimes and have potentially severe penalties for those who are found guilty.

An Overview Of HMRCs Approach To Tax Fraud. Hylton-Potts - The London Based Law Firm helping people across the UK. Hylton-Potts are experienced Benefit Fraud and Tax Credit Fraud Lawyers.

Deep bench of experienced lawyers with an approachable style Legal 500 UK 2021. British Lawyer Found Guilty After Trial For His Participation In Multimillion-Dollar Tax Fraud Scheme Involving Swiss Bank Accounts. Cheating the public revenue Long before any of the statutory offences as detailed above were passed into law the tax authorities relied upon the common law offence of Cheating the Public Revenue.

Draycott Browne is one of the UKs top criminal law firms. Practical Law may have moderated questions and answers before publication. UK law enforcement has seized NFTs as part of an investigation into suspected tax fraud worth 19 million BBC reported Monday.

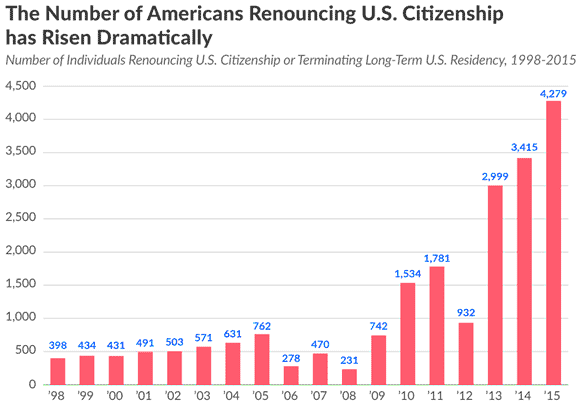

If youve received a letter about an Interview Awkward Documents or Overpayments call or email us today. An Introduction to UK-wide. In fact Richard Hatch the first winner of the television show Survivor was recently jailed for not paying federal taxes on his 1 million winnings.

The support of our criminal defence lawyers in London starts with complete verification of the case which in most cases will involve the companys accountants. Our Fraud Solicitors have practised within this area of law for over 25 years. The former top lawyer at a financial company accused of taking part in a 19 billion fraud against the Danish revenue agency has proclaimed ignorance of any wrongdoing saying he held no tax.

Annually we collect hundreds of thousands of responses from clients the majority.

Impact Of Brexit On Tax Global Law Firm Norton Rose Fulbright

Cerb Cra S Tax Audit Canadian Tax Lawyer Analysis

Tax Attorney Facing Prison For Allegedly Helping Billionaires Robert Smith And Bob Brockman Dodge The Irs

Richard Branson Tax Fraud How A Youthful Indiscretion Helped Create A Billionaire

Tax Avoidance Confessions Of An International Tax Lawyer 2018

Billionaire Robert Brockman Says Doctors Wrongly Helped U S In Tax Fraud Case Bloomberg

Hmrc Tax Disputes Solicitors Barristers London Tax Lawyers

Trump Organization And Financial Head Weisselberg Ask Judge To Toss Tax Fraud Case Pbs Newshour

The Tax Lawyer William D Hartsock Tax Attorney Inc

Billionaire Brockman Innocent Of Tax Fraud U S Witness Says In Surprise Bloomberg

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Tax Avoidance Confessions Of An International Tax Lawyer 2018

Attorney Involved In Biggest Tax Fraud Prosecution Ever Loses Appeal Of Conviction

Irs Whistleblower Program Get A Reward For Reporting Tax Fraud

Tax Evasion Best Tips To Legalize Your Offshore Money Fast

Tax Avoidance Confessions Of An International Tax Lawyer 2018

What Is The Difference Between Tax Fraud And Tax Evasion

Tax Evasion Latest News Breaking Stories And Comment The Independent